I. Introduction

A. Definition of Silver Bars

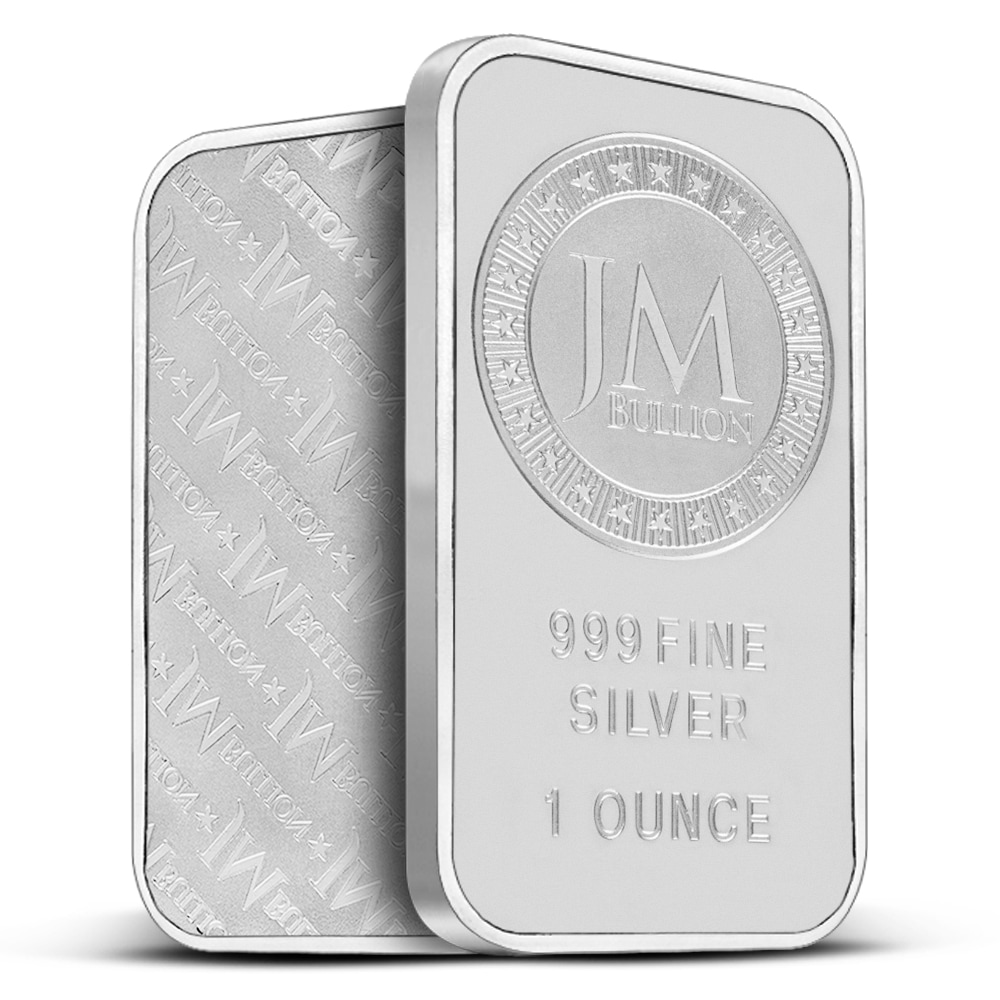

Silver bars are rectangular blocks of pure silver, typically weighing one troy ounce (31.1 grams) or multiples thereof. They are produced by refineries and mints, and are often stamped with hallmarks indicating their purity and origin. Silver bars serve as a convenient and standardized form of silver investment, offering a direct exposure to the metal’s price movements.

B. Brief History of Silver as a Precious Metal

Silver has been prized by civilizations for millennia, valued for its malleability, durability, and lustrous appearance. Its scarcity and perceived value have made it a coveted commodity throughout history. Silver’s earliest known use dates back to ancient Mesopotamia, where it was employed for jewelry, utensils, and decorative objects.

C. Significance of Silver Bars in Ancient Civilizations

In ancient civilizations, silver bars played a significant role in trade, commerce, and monetary systems. Their standardized weight and purity made them a convenient medium of exchange, facilitating transactions across vast distances. Silver bars also served as a store of wealth, retaining their value over time and acting as a hedge against inflation.

II. The Rise of Silver Bars in Medieval and Early Modern Times

A. The Use of Silver Bars in Trade and Commerce

During the Medieval and Early Modern periods, the use of silver bars in trade and commerce expanded considerably. The growth of international trade routes and the establishment of merchant networks fueled the demand for standardized forms of currency. Silver bars, with their inherent value and widespread acceptance, became a preferred means of payment for goods and services.

B. The Role of Silver Bars in Monetary Systems

Silver bars played a crucial role in the development of monetary systems during these eras. Many countries adopted silver as their primary monetary standard, with silver bars serving as the basis for their currencies. The minting of silver coins from standardized silver bars ensured consistency in weight and purity, facilitating commerce and financial transactions.

C. The Establishment of Silver Refineries and Mints

To meet the growing demand for silver bars and coins, refineries and mints were established across Europe and beyond. These facilities specialized in extracting silver from ore, refining it to high purity, and casting it into standardized bars. The establishment of these institutions standardized the production and quality of silver bars, further enhancing their role in trade and finance.

III. Silver Bars in the Age of Exploration and Colonialism

A. The Spanish Silver Mines and the Global Silver Trade

The discovery of vast silver deposits in the Americas, particularly in Spanish colonies, revolutionized the global silver trade. The influx of silver from these mines fueled economic growth and expansion worldwide. Silver bars became a central element in international commerce, financing exploration, colonization, and the establishment of global trade networks.

B. The Use of Silver Bars in Financing Exploration and Colonization

The wealth generated from silver mining played a pivotal role in financing European exploration and colonization. Silver bars were used to fund expeditions, establish settlements, and acquire goods and services from local populations. The flow of silver from the Americas transformed the economies of Europe, driving inflation, stimulating investment, and shaping the course of global history.

C. The Impact of Silver on the Economies of Europe and the Americas

The influx of silver had a profound impact on the economies of both Europe and the Americas. In Europe, the surge of silver wealth fueled economic growth, stimulated manufacturing, and expanded trade networks. However, it also led to inflation, social unrest, and economic disparities. In the Americas, the exploitation of silver mines and the extraction of silver from indigenous populations had devastating social and environmental consequences.

IV. Silver Bars in the 18th and 19th Centuries

A. The Industrial Revolution and the Demand for Silver

The Industrial Revolution brought about a renewed demand for silver, driven by its use in various industrial applications. Silver’s conductivity, malleability, and resistance to tarnishing made it an ideal material for electrical components, cutlery, and decorative objects. The growing demand for silver in industry further solidified its importance in the global economy.

B. The Transition from Silver to Gold as the Primary Monetary Standard

Despite its continued industrial applications, silver gradually lost its prominence as the primary monetary standard during the 18th and 19th centuries. Gold emerged as the preferred monetary metal, with many countries adopting gold-based currency systems. This transition was driven by several factors, including the discovery of gold reserves, the perceived greater stability of gold prices, and the desire for a more standardized global monetary system.

C. The Continued Use of Silver Bars in Trade and Investment

Despite the transition to gold as the primary monetary standard, silver bars continued to play a significant role in trade and investment. They were used as a store of value, a hedge against inflation, and a component of investment portfolios. Silver bars also retained their importance in international trade, particularly in regions where gold was not readily available or acceptable as currency.

V. Silver Bars in the 20th and 21st Centuries

A. The Great Depression and the Rise of Silver Prices

The Great Depression of the 1930s significantly impacted the silver market. As economic activity contracted and deflation gripped the world, governments around the globe resorted to silver purchases to increase monetary circulation. This intervention led to a surge in silver prices, making silver bars an attractive investment for those seeking protection against economic turmoil.

B. The Role of Silver Bars in the Post-World War II Era

Following World War II, the Bretton Woods Agreement established the US dollar as the world’s reserve currency, pegged to the price of gold. This system temporarily diminished the role of silver in international finance. However, silver bars continued to be used in industrial applications and remained a valuable commodity for investment.

C. The Resurgence of Interest in Silver Bars as an Investment

In recent decades, there has been a renewed interest in silver bars as an investment. Factors such as rising inflation concerns, geopolitical uncertainties, and the volatility of stock markets have driven investors towards tangible assets like silver. Additionally, the growing demand for silver in new technologies, including solar panels and electric vehicles, has further bolstered its long-term investment potential.

VI. The Significance of Silver Bars in Modern Precious Metal Markets

A. Silver Bars as a Store of Value and Hedge Against Inflation

Silver bars have a long history as a store of value, retaining their purchasing power over extended periods. Unlike fiat currencies, which can be subject to inflation, silver offers a hedge against rising prices. This characteristic makes silver bars an attractive option for investors seeking to preserve their wealth over the long term.

B. Silver Bars as a Component of Investment Portfolios

Silver bars can play a valuable role in diversifying an investment portfolio. Unlike stocks or bonds, which are often correlated with the broader market, silver prices can move independently. This diversification can help mitigate overall portfolio risk and provide stability during periods of market volatility.

C. The Role of Silver Bars in Industrial Applications

While silver’s historical role in monetary systems has diminished, its industrial applications remain significant. Silver’s unique properties make it essential for a wide range of products, including electronics, medical devices, and solar panels. The ongoing demand from these industries provides a fundamental support for the price of silver.

VII. Factors Affecting the Price of Silver Bars

A. Supply and Demand Dynamics

The price of silver bars is primarily determined by supply and demand dynamics. Factors influencing supply include silver mine production, government stockpiles, and recycling rates. Demand, on the other hand, is driven by factors such as industrial consumption, investment activity, and jewelry production. Shifts in any of these factors can lead to fluctuations in the price of silver bars.

B. Economic Factors and Market Conditions

Economic factors and broader market conditions can also influence the price of silver bars. During periods of economic growth, increased industrial demand can drive up silver prices. Conversely, economic downturns can lead to decreased demand and lower silver prices. Additionally, factors such as interest rates, inflation expectations, and global economic uncertainty can all influence investor sentiment, impacting the price of silver.

C. Geopolitical Events and Global Uncertainties

Geopolitical events and global uncertainties can create volatility in the precious metal markets, including the silver market. Political instability, trade wars, and natural disasters can all disrupt the supply chain and influence investor behavior. During times of uncertainty, silver bars can become a safe-haven asset, attracting investors seeking a hedge against risk and leading to potential price increases.

VIII. Investing in Silver Bars: Considerations and Strategies

A. Understanding the Risks and Potential Rewards of Silver Bar Investment

Investing in silver bars carries inherent risks, just as any investment does. Silver prices can fluctuate significantly, and investors should be prepared for potential losses. Additionally, silver bars require secure storage and may have lower liquidity compared to other investment options. However, silver also offers potential rewards for long-term investors. Over time, silver prices have generally trended upwards, and silver bars can provide a hedge against inflation and portfolio diversification.

B. Choosing Reputable Dealers and Secure Storage Options

When considering investing in silver bars, choosing reputable dealers with a proven track record is crucial. Look for licensed dealers who offer competitive prices and guarantee the authenticity of their products. Additionally, ensure you have secure storage options for your silver bars. Consider investing in a high-quality home safe or utilizing bank vault services for larger holdings.

C. Implementing a Long-Term Investment Strategy

Silver bar investment is best suited for a long-term horizon. Silver prices can be volatile in the short term, but historically, they have shown a tendency to appreciate over time. Develop a well-defined investment strategy, considering your investment goals, risk tolerance, and budget. Dollar-cost averaging, by making regular purchases over time, can help mitigate the impact of price volatility.